Invox Finance’s decentralized platform allows dynamic invoices to be created on a distributed ledger, benefiting all parties from an increase in trust, transparency, efficiency, and security with minimal fees. Invoice fragmentation allows investors to spread their risk across hundreds of invoices, allowing for very low-risk investments with maximum returns.

What is Invox Finance?

Invox Finance is an invoice lending platform (AKA invoice factoring) that helps millions of business owners to accelerate and smooth out their cash flow. In fact, it’s so helpful that the global market is valued at approximately US$2.8 trillion and is used by local family businesses all the way up to the fortune 500 companies.

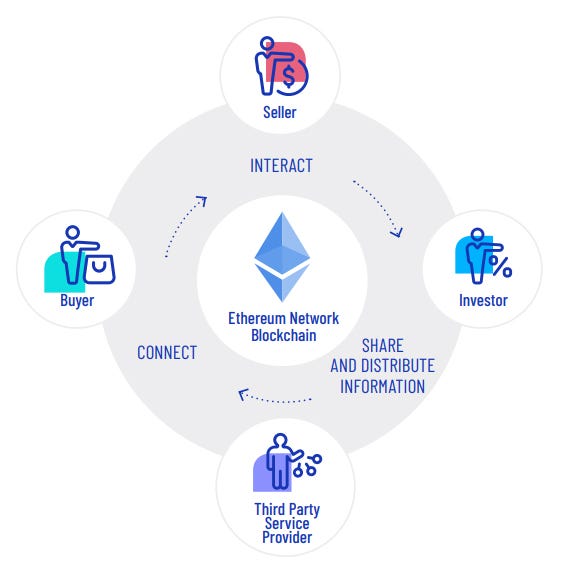

How does Invox Finance work?

Invox Finance is a decentralized peer-to-peer invoice lending platform being built on distributed ledger tech that will make invoice financing cheaper, more accessible and more transparent. Invoice financing is not like other peer-to-peer lender value propositions, here are some key points:

- Invox Finance will bring all parties together (buyer, seller, investor) to facilitate a open and honest trust networking in the trade of invoices.

- Invox Finance will give all parties access to a greater chunk of data transparency in the buying / selling / investing of factored invoices.

- Invox Finance will fragment invoices into smaller segments to give less risk exposure and a more diversified investment opportunity to investors (as opposed to having all your investment eggs in one invoice).

- Invox Finance sellers can trade accounts receivable invoices to accelerate cash flow.

Competitor

Currently, in the decentralized invoice financing environment Invox Finance has only two competitors (that im aware of) — Populous (PPT) and Hive Project (HVN). Populous has a market value at over $542 million dollars and Hive Project is valued at $22 million dollars (at the time of writing). The invoice financing environment is ripe for disruption, and Invox Finance, Populous and Hive Project are positioned in the enviable position to front-run this transition.

Invox Finance features

Some of the key features of invox finance include:

- Low token price ($0.085)

- Low hard cap and reasonable supply: minimum supply of around 320 million tokens and maximum total supply of 464 million tokens

- Solves real world problems in a growing market segment: many companies face the problems of cash flow and invoice factoring is only going to grow (with the state of our economy and debt levels IMO)

- Will incentive users: the structure of the platform incentivizes users to get on board and actually use it. It will also impress potential investors by getting rewarded with the tokens and buyers are getting rewarded for verifying invoices.

- Already a working project with customers from an established invoice factoring business

- Experienced team in chosen industry

- Highly targeted niche, pinpointed market focus

- One more thing id like to bring to the table (not mentioned in the whitepaper), is the future token utility mentioned by the team in telegram, where in the holders of the Invox token will be able to directly invest into invoices using the INVOX token (timeline for this still TBA)

Problem Solving

Invox finance aims to solve a number of problems in today’s invoice financing industry, including:

- Lack of contact between involved parties

- Transparency issues surrounding the the entire process of invoice factoring

- Removing the risk of fraud

- Security and mortgage issues

- Risks to investors

Rewarding all parties involved

These people can benefit from this platform in the following ways:

- Investors can get access to higher rates of returns while diversifying their investment portfolio

- Sellers sells their invoices to stimulate their cash flow

- Buyers can receive continued invoice payment periods then be rewarded for verifying invoices

Invox Finance Conclusion

Invox Finance intends to be a powerhouse in the new era of blockchain invoice factoring. Its main goal is to create a decentralized P2P platform where sellers, buyers and investors connect in invoice trade. Invox Finance will solve the major problems in traditional invoice financing, including risk and lack of transparency between buyers sellers and investors. The biggest conclusion i would like to draw is the future benefits for investors of being able to invest in invoices on the Invox platform. Passive Income? Yes Please! > Website: https://www.invoxfinance.io/ | Whitepaper: https://www.invoxfinance.io/docs/Invox-Whitepaper.pdf

As always use this information as a guidepost for further research. Never take anyone’s advice on investments (not even financial advisers). Delve into the project via their social media profiles, search the project on bitcointalk.org, duckduckgo.com and reddit.com and only put money in that you can afford to lose. Cryptocurrency is risky — Fiat is a dead man walking.

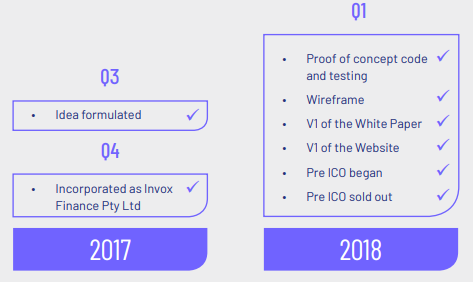

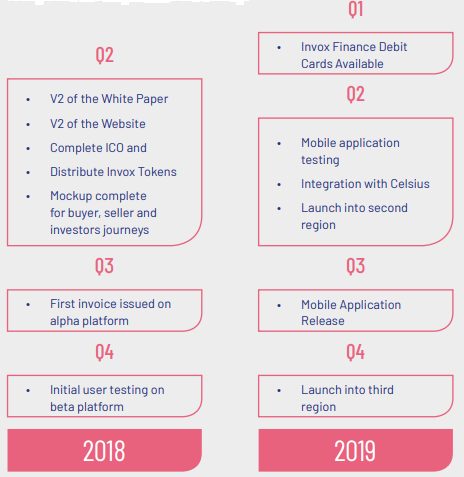

Roadmap

Team

The Invox Finance team consists of Alex Mezhvinsky (Co-Founder), Adam Mezhvinsky (Co-Founder), Daniel Tang (Co-Founder), Victoria Mezhvinsky (In House Legal Counsel), Jose Luis (Lead Software Engineer), Lucas Cullin (Lead Solidity Developer — contractor) and Henry Sit (Business Development Manager). Before it’s launching, the team founded ABR Finance, one of the Australia’s leading invoice financing solutions.

The company is based in Adelaide, Australia.

For more information detailed :

- Website: https://www.invoxfinance.io/

- AnnThread: https://bitcointalk.org/index.php?topic=3048498.0

- Twitter: https://twitter.com/InvoxFinance

- Facebook: https://www.facebook.com/Invox-Finance-162381191061327/

- WhitePaper: https://invoxfinance.io/docs/Invox-Whitepaper.pdf

- Telegram: https://t.me/InvoxFinanceCommunity

Author : ardibimbim

No comments:

Post a Comment